Dmitriy Perelstein, White Rabbit (DP): Hello @emmiechang . Welcome to White Rabbit! Please introduce yourself and your project!

Emmie Chang, Superbloom (EC): Hi! I'm Emmie Chang, CEO of Superbloom. Superbloom's a simplified crypto finance platform powered by SEED , a membership token. We make it easy for members to buy, manage, and trade crypto starting with vetted pre-sales with ZERO fees or commissions.

DP: Emmie, so help us understand this: Is Superbloom a fund?

EC: Superbloom isn't a fund. When people buy SEED token, they get 10-20% of their holdings in airdrop rewards from high quality projects we vet and do due diligence for. So we don't invest on a user's behalf or pool funds--but rather use the Superbloom treasury to buy really great Tokens and distribute them FREE to our users.

DP: How does the vetting process go? Do you have a team that does the research and analysis?

EC: We're a lean team -- which allows us to move fast. So we rely on a global network of over 25 investment funds and ICO leaders to send us their initial research. Then, we put them through the Superbloom Quotient and analyze each deal

Kurt Braget, White Rabbit (Kurt): Emmie actually I like the way the platform is looking these days, it's come a long way, I'm curious for somebody like me who wants to get in and support what you're doing, or if I want to invest, what is the best way?

EC: Our first report will be out in June along with our first set of airdrops--happening 1-3 times/month. In the beginning.

DP: What's a Superbloom Quotient?

EC: It's a set of metrics we combined that has three main factors. 1. Angel Investment/VC criteria 2. Business Development/ecosystem development skill set and 3. Investor Relations ability. For most startups (1) is the most important for the first few years, and then (2) after a Series C or D then (3) after going public -- which can be 10 years. For ICO's the founding teams need to have the skill set to develop all 3 up front in order to be successful. This is a new model and it's hard -- but the best founders, we realized, can manage all 3.

Kurt: https://www.superbloom.com/ https://www.superbloom.com/whitepaper

A screenshot from the site:

DP: Cool. Can you give us examples of projects that you had go thru the quotient and pass all 3?

EC: haha i can only give you the ones i personally participated in using this criteria in 2017. So in 2017, I picked Powerledger. And early 2018 Nucleus.Vision, as well as Enigma.

DP: Can you talk about tokenomics of SEED – your token. Is that considered a security token?

EC: It's not a security-- we spent hundreds of thousands of dollars on attorneys to learn the rules and regulations of the large countries to make sure we ARE NOT a security. SEED holders get not only ACCESS but FREE TOKENS from the vetted deals -- (we usually buy them ).

Deal flow is not a problem for most people == GOOD DEAL Flow is the problem we're solving. And nobody wants to vet and read white papers and do research, so we filter it down for you -- and give you tokens. So even if you do nothing, you can Buy some SEED, plant it on our platform, and watch it BLOOM --> ideally into a SUPERBLOOM 😻

DP: I wouldn't say "nobody" but a lot of people, you are right 😉

EC: Yeah -- most people dont want to read tons of research ;) (me included! )

Kurt: Emmie are you guys officially launched? what does the roadmap look like now? i know you guys have been working hard.

EC: Thanks! - we're launching the super simple basic dashboard next week, with most functionality to launch by end of month on token release. Then JUNE Is a big month as we drop our first Rewards + launch some pieces of the front end of an exchange -- built entirely on Stellar.

DP: That's a big deal. Lots of EOS fans here hehe. Why Stellar?

EC: I'm personal friends with the CEO of Stellar and have been for the past few years! we LOVE their philosophy of building value through AIRDROPS. They never did a crowdsale, and have been scrappy and self funded except for a loan in the beginning. Jed McCaleb, the CEO is a true believer in crypto--and we align with their values. On the other hand, EOS is a great product, and raising $1B in open marketplaces is awesome-- congrats for them to do that! For Stellar, to be a top 10 coin with only a <$3M loan, that's amazing. Jed is more of a partner to the platform. In that Stellar is helpful and we are building on them!

Kurt: "Our sale is currently open to non-US citizens. We will let you know when this changes." Will this change in the future?

EC: For tokens, definitely! No accredited investors in the US, right now. When we launch for the US, everyone will have opportunities! I don't believe in the 'accreditation' rule that just if you make $200k and have assets of $1M + that you're a 'smarter investor'. So i'd rather not let any Americans until we can let them all ;) Non US Citizens that are NON US residents can participate. So i technically can't even sell when I'm in the US. ;) so i'm spending a lot of time outside. We did this -- because we've heard a lot of companies get subpoena'ed for SEC. And we don’t want that. FOR THE RECORD: We have NEVER been investigated, received a subpoena OR been sent a request for information from any governmental agency involving securities or the act of selling illegal securities. Within one year, the token will be widely trade-able on US securities exchanges. For ANYONE and everyone!

Kurt: Emmie what kind of partnerships are you guys looking for? how can ICOs engage with you guys, how much will they pay and what can they expect?

EC: haha -- we don't charge ICO's anything. That's part of the beauty- the best things in life are FREE and can't be bought ;) For ICO's, we only buy a small amount, maybe range of $100-500k for our treasury and airdrop community. If the company's have extra allocation, we sometimes offer additional sale to the members.

DP: How much capital have you already raised and what's your target?

EC: We're not raising capital :) we're selling tokens! Our hard cap is $29M and over 1/3rd is from Asia. And we're closing out the final amounts with a few strategic funds this week. As our community grows, we're considering a community token sale for our biggest supporters at the end of the month (MAY).

DP: So what happens then when you run out of $29M? Doesn't this deplete your treasury? How will you participate in future token buys after that?

EC: Well, first of all, we only allocate 10-20% of the token holdings into buying new tokens. Annually. So with bonuses and ecosystem development, year one is around $5-7M. Plus, we buy tokens for our treasury along with our airdrops. When those tokens rise in price, we build our treasury. So we grow when you grow. The more members come in, they continue to have more demand for SEED token to get these airdrops and access to great deals, and the cycle continues.

DP: Gotcha! So tell us more about the team and company. Where are you located, who is on the team etc?

EC: It's been tough -- my whole network is within San Francisco, with VC's, angel investors, and founders. When we decided this global strategy, I went on a roadshow and flew over 200k miles since September to meet industry people and learn how to close this out. Yes ! We're based in San Francisco, our CTO is in Palo Alto (30 miles south) and Our company is registered in the Caymans.

Kurt: Emmie which country in Asia is most interest? Korea? China?

EC: Asia -- it's a lot of China, Singapore, HK (although that's china) but I noticed a ton of user base from Indonesia and Vietnam also!. We'll be hiring for the Caymans and Singapore soon ;)

Kurt: Emmie what kind of positions are you hiring for?

EC: https://angel.co/superbloom/jobs all our job listings are here! ;)

Josh: What's the most interesting region specific demand insight you could give to founders planning an ICO who follow white rabbit?

EC: It's all about retail investors in southeast Asia and China. In China they call them "jio tsai" or https://en.wikipedia.org/wiki/Allium_tuberosum which is a funny name since it grows fast and the syndicate leaders 'cut them down'. I think it's funny. But also Asia is SOOO fast paced--they are merely into the finance part of things--trading and after markets. Rather than core fundamental product + ecosystem development.

Josh: Oh awesome. Any other Googleable terms for founders to look At? Those industry specific lingo are usually pretty awesome doors to open.

EC: hmm..i think that's the funniest one i've heard. the "Kim Chi Premium" is what I've heard Americans refer to Korea ;) But it is definitely NOT what they use in Korea.

DP: Who do you consider to be your main competitors and what do you do differently? What are your core strengths?

EC: Competitors-- i think there's a lot of companies making it easy. Coinbase for one. But we're not focusing on FIAT. We're doing things differently -- however, i would say, we directly compete for (1) People's money to buying tokens, so all ICO's (2) their information and resource for identifying ICO's, that's all those listing sites and (3) for exchanges, we're going head to head with some of the big guys. However, we're going to evolve one step at a time, with our user base ;) I really like TrustUSD. And their model of accepting FIAT. I don't personally trust ANY exchange with my FIAT or want them touching my bank accounts. TRUSTEES work with giant hedge funds, so it should be a 'cashier' like a casino--where you turn in our cash for chips. then your chips can be used anywhere. Then when you want to cash in chips, you go to the cahsier ;)

DP: How are you related to the Titans of Crypto group on FB?

EC: We have the website: www.titansofcrypto.com I made as a fun group! And now it's a voting platform for Conferences -- like Shark Tank meets American Idol. We give everyone $10k in fake money to 'vote/contribute' to companies on each contest. And eventually when these company's launch their tokens, we'll have portfolio tracking capabilities -- so you're a TITAN OF CRYPTO with fake money ;)

Kurt: Emmie i noticed you guys have a rating on ico bench now. Do they require payments for the ratings? or do they just do them without permission?

EC: No! We submitted, but yes, their rating is all organic. We submitted our company to them--they have a premium offering, but we're not paying.

Can you guys do me a favor and subscribe to our reddit? www.reddit.com/r/superbloom

DP: btw Emmie, we've done a bunch of these AMA's and you are the second woman guest! First one was Toni Lane! We definitely want to expand that. Any recos on who we should speak to?

EC: Recommendations? Meltem Demirors is awesome. And Hope LIu from Eximchain. @abshier who was part of Cofound.it and now DNA !

DP: I can't remember if we talked about the dates yet. What are they for your token sale and airdrop?

EC: Airdrop campaign is still going on now! www.superbloom.com/bonus for NON Americans ;) And token sale date-- we "might" do a community sale last days of May

DP: Cool. What else have we not asked you that you would like to share?

EC: Hmm.. let's see -- maybe what the price of BTC will be by December 2018? i predicted BTC $40-50k last year in December for December 2018.

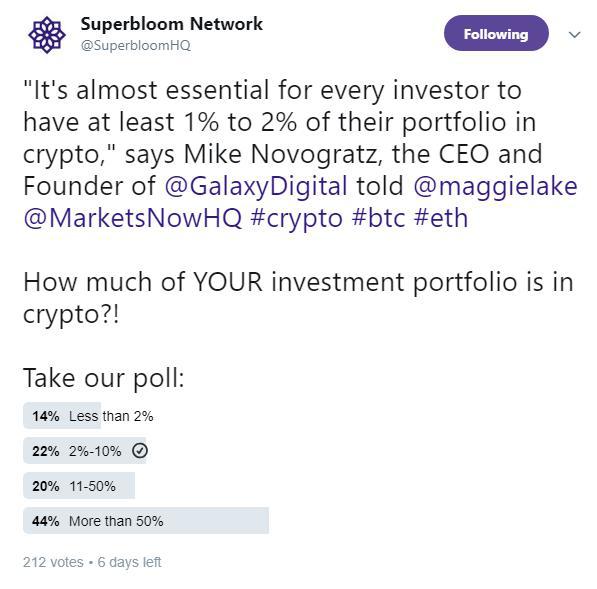

Also -- can you guys fill out this poll. https://twitter.com/SuperbloomHQ/status/994356385830719489

DP: Looking at your survey. Wow! Lots of people are piled in in crypto!

EC: Crazy right? but maybe that's our audience!

Kevin: Can you go into your syndication tools and plans to improve them?

EC: We think it's TOO easy for syndication leaders and POOL MASTERS to steal people's money. So we want to build a tool to make it easier to track, and manage that.

Kurt: @emmiechang where can we follow the most recent updates about Superbloom? I was in the Telegram but I hate watching people ask about airdrops over and over 😜

EC: Follow us: www.twitter.com/superbloomhq Join our Telegram @superbloom @superbloomnews and on Medium www.medium.com/superbloom . We're going to be publishing there more often.

DP: ok, thank you very much for your time @emmiechang ! Good luck to Superbloom and let us know if we at White Rabbit can help in any way!